TDS applies to the redemption of mutual fund models for NRI. The precise price of TDS depends upon the type of scheme and the holding time period. Make sure you refer to the above site with the costs as well as the applicability of TDS on mutual resources for NRI.

NRIs are liable to pay taxes over the money obtain earned from Liquid cash. Following the Price range 2023 amendments, prolonged-phrase capital gains won’t love any indexation reward and can be billed as per the Trader’s slab costs eradicating the LTCG Added benefits completely.

Obtain your tax refund up to 5 times early in your bank account: If you end up picking this compensated add-on element, your federal tax refund might be deposited in your selected bank account nearly 5 days prior to the refund settlement date furnished by the IRS (the date your refund would've arrived if sent through the IRS instantly). The receipt of one's refund up to five Days Early is topic to IRS submitting refund info to us at least five days ahead of the refund settlement day. IRS would not normally present refund settlement facts five days early.

As such any gains arised from floater cash will now draw in taxation on relevant slab rates of the investor’s money bracket.

But In spite of this fact, the claimed NRI used to spend funds gains tax, as in INR terms he gained Rs twenty. This exact dilemma is just what the forex fluctuation reward solves beneath the new Earnings Tax Monthly bill, here 2025.

Legal worries spanning a number of countries might be emotionally and fiscally taxing. For NRIs and OCIs, being familiar with each Indian and Australian legal devices is critical. A legislation organization Launceston specialising in NRI legal services is an invaluable source, providing skilled direction on matters like relatives law, property disputes, and estate planning.

NRIs must report their taxable profits properly and be certain compliance with Indian tax regulations. Non-reporting of taxable cash flow can cause penalties and legal outcomes.

Regretably, your browser just isn't supported. Make sure you down load a person of those browsers for the top experience on usatoday.com

If you will need personalized guidance to trace your progress and assist you to succeed—we Have you ever covered.

Yes, NRIs can file for divorce in Australia, but the procedure depends upon the recognition of Indian marriages underneath Australian law. We could manual you on how to navigate this.

Earning a legally legitimate will is Just about the most basic, nonetheless significant methods for estate planning. A will permits NRIs to obviously point out who their legal heirs are and how they wish to divide their assets situated in India.

MyGate’s seamless application interface can make it easy for NRIs to remain connected and knowledgeable about their properties in India.

Suggestion Go for quality services if you have significant-conclusion Homes that demand much more notice to detail. Share on X

PropertyAngel is actually a trustworthy name in top quality property management services, functioning mainly in Bangalore.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Michael Bower Then & Now!

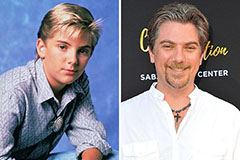

Michael Bower Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!